BTC Price Prediction: 2025-2040 Outlook Amid Technical Consolidation and Institutional Adoption

#BTC

- Technical Outlook: BTC consolidating below 20-day MA with mixed momentum signals

- Market Sentiment: Strong fundamentals face near-term technical resistance

- Long-Term Trajectory: Scarcity and institutional adoption drive multi-decade bull case

BTC Price Prediction

BTC Technical Analysis: Short-Term Consolidation Likely Before Next Move

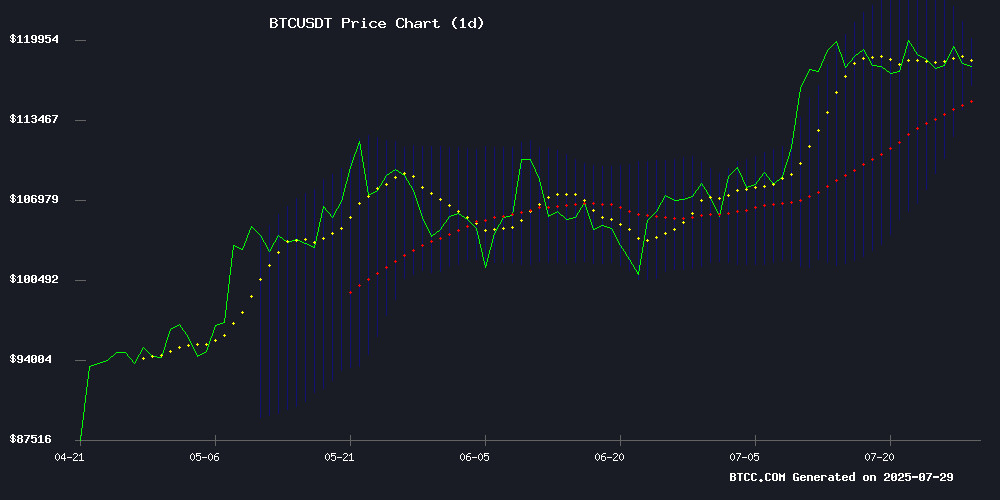

BTCC financial analyst Emma notes that BTC is currently trading slightly below its 20-day moving average (118,189 USDT), with the MACD histogram showing bullish convergence (-1,308 vs -3,338). The price sits comfortably within Bollinger Bands (116,299-120,079), suggesting range-bound action in the NEAR term. 'The technical setup shows BTC is digesting recent gains,' says Emma. 'We see strong support at 116,300 and resistance at 120,000 - a breakout either way could determine the next major trend.'

Market Sentiment: Bullish Fundamentals Face Technical Headwinds

'The news FLOW remains overwhelmingly positive for Bitcoin,' observes BTCC's Emma, pointing to ETF inflows ($150B YTD), halving anticipation, and macro triggers like US-China trade developments. However, she cautions: 'Technical indicators and whale activity suggest potential short-term volatility. The $120K resistance level and double-top pattern warrant caution despite strong fundamentals.' Galaxy's BTC sales and ETF delays create near-term uncertainty, but institutional adoption (1.29M BTC in ETFs) provides structural support.

Factors Influencing BTC's Price

3 US Crypto Stocks to Watch in August

Galaxy Digital Inc (GLXY) captured market attention after facilitating one of the largest Bitcoin transactions this year—executing an 80,000 BTC sell order that briefly rattled prices. The stock dipped to $30.59 on July 25 but rebounded to $31.99 in pre-market trading, with $33.17 emerging as a near-term resistance level. Volatility remains likely as institutional activity intensifies.

Cipher Mining (CIFR) enters the spotlight ahead of its Q2 2025 earnings release, with analysts scrutinizing operational metrics amid fluctuating bitcoin mining economics. Meanwhile, RIOT Platforms continues to leverage its industrial-scale mining infrastructure, though details on August catalysts remain undisclosed.

Solo Bitcoin Miner Defies Million-to-One Odds to Win $373K Block Reward

A solitary Bitcoin miner has beaten staggering 4.26 million-to-1 odds to successfully mine block 907,283, claiming a $373,000 windfall. This astronomical improbability—278 times less likely than being struck by lightning—spotlights the near-impossible challenge of solo mining against today's 600 EH/s global hashrate.

The victory harks back to Bitcoin's early days when individual miners dominated, before industrial-scale mining pools emerged in 2013. Now accounting for 99% of blocks, pools have rendered solo mining a quixotic pursuit—a high-cost gamble where hobbyists trade certain electricity expenses for lottery-like jackpot potential.

Bitcoin's 2028 Halving: Scarcity Engine Primed for Another Bull Cycle

Bitcoin's quadrennial halving event, scheduled for spring 2028 at block 1,050,000, will slash mining rewards to 1.5625 BTC per block—down from 3.125 BTC post-2024. This algorithmic scarcity mechanism, hardcoded by Satoshi Nakamoto, continues to throttle supply inflation toward zero until the final satoshi is mined circa 2140.

Historical patterns suggest fireworks ahead. Each previous halving—2012, 2016, 2020—ignited exponential price rallies as supply shocks collided with demand. Analysts now project 2028 price targets between $150,000 and $300,000, though such forecasts hinge on Bitcoin maintaining its dominance as 'digital gold' amid evolving macroeconomic conditions.

Bitcoin Faces Resistance at $120K as Binance Whale Activity Signals Potential Correction

Bitcoin's rally stalled near the $120,000 psychological barrier, with the cryptocurrency retreating to $118,900 after peaking at $119,760. The rejection comes alongside concerning on-chain data showing substantial whale deposits into Binance—historically a precursor to price declines.

Exchange analytics reveal a $1.2 billion surge in institutional inflows to Binance on July 25, triggering $141 million in long liquidations. While retail investors continue gradual exchange deposits, the disproportionate whale activity suggests concentrated selling pressure may dominate near-term price action.

The divergence between retail and institutional behavior paints a fragile technical picture. Market participants now watch the $110,000 support level as a critical test of Bitcoin's bullish structure.

SEC Delays Decision on Trump Media's Bitcoin ETF to September 2025

The U.S. Securities and Exchange Commission has extended its review period for the Truth Social Bitcoin ETF, pushing a potential decision to September 18, 2025. The fund, tied to former President Donald Trump's social media platform, seeks to offer traditional investors exposure to Bitcoin without direct cryptocurrency ownership.

This delay underscores regulatory caution as politically branded crypto products enter mainstream finance. Approved Bitcoin ETFs have seen record demand, but the SEC cited needing "sufficient time" to evaluate the proposal. A green light would further cement Trump's influence in digital assets while adding a partisan dimension to the burgeoning ETF market.

Galaxy's Massive BTC Sale Triggers Market Pullback

Galaxy Digital executed a significant Bitcoin sell-off between July 21 and July 27, 2025, liquidating over 80,000 BTC valued at more than $9 billion. The MOVE precipitated a notable market correction as institutional supply overwhelmed near-term demand.

The sale ranks among the largest single-entity divestments in Bitcoin's history, sparking debate about strategic portfolio rebalancing versus loss-taking behavior. Market analysts observe this could signal a shift in institutional custody strategies amid evolving regulatory landscapes.

90-Day US-China Tariff Truce Sparks Bitcoin Optimism, $120K Target in Sight

A tentative truce between Washington and Beijing has injected fresh Optimism into cryptocurrency markets, with Bitcoin traders eyeing the $120,000 milestone. The 90-day extension of tariff negotiations offers respite from the $700 billion trade war that has rattled global markets since 2018.

Third-round talks in Stockholm aim to address longstanding disputes over technology rules and intellectual property transfers. Market participants interpret the diplomatic pause as a potential precursor to structural solutions, particularly as China shows willingness to engage despite domestic economic headwinds.

The tariff détente coincides with renewed focus on fentanyl-related chemicals in trade discussions, adding complexity to negotiations. Cryptocurrency markets appear to be pricing in reduced macroeconomic uncertainty, with Bitcoin leading the charge as a barometer of risk appetite.

Bitcoin ETFs Amass 1.29M BTC as Inflows Exceed $150B Since January Launch

Spot Bitcoin ETFs have surged past $150 billion in assets under management, now holding over 6% of Bitcoin's total circulating supply. BlackRock's IBIT leads the pack with $87.5 billion AUM as institutional demand continues outpacing new BTC issuance post-halving.

The ETF wrapper has democratized Bitcoin exposure while introducing traditional market risks—custodial dependencies, management fees, and amplified volatility. These instruments have fundamentally reshaped BTC's supply dynamics, with authorized participants arbitraging between primary and secondary markets to maintain NAV alignment.

Regulatory approval in January marked a watershed moment for crypto-traditional finance convergence. The structure eliminates direct blockchain interaction while providing regulated exposure—a tradeoff that's attracted both retail investors and institutional allocators.

MARA Completes $950M Convertible Notes Offering for Bitcoin Expansion

MARA Holdings has finalized an upsized $950 million offering of 0.00% convertible senior notes due 2032, signaling a strategic push into Bitcoin accumulation and infrastructure scaling. The move underscores a broader trend among crypto miners leveraging capital markets for competitive advantage.

Net proceeds of approximately $940.5 million will primarily fund Bitcoin acquisitions and corporate expansion, with $18.3 million already allocated to repurchasing existing notes. Institutional demand for Bitcoin, fueled by ETF inflows, continues reshaping miners' capital allocation strategies.

Bitcoin Eyes $130K Amid Breakout, Trade Deal, and Macroeconomic Signals

Bitcoin's monthly close above a multi-year resistance trendline has ignited bullish sentiment among analysts. Pseudonymous trader Doctor Profit identifies this technical breakout, combined with favorable macroeconomic conditions, as a catalyst for a potential rally toward $130,000.

The recent U.S.-EU trade deal, featuring $1.35 trillion in combined energy exports and infrastructure investments, creates a favorable backdrop for risk assets. Market participants anticipate capital inflows into both traditional equities and cryptocurrencies as the agreement stimulates economic activity.

Technical analysis suggests Bitcoin has completed its retest phase after four months of consolidation below the critical resistance level. The clean breakout on monthly charts indicates growing institutional confidence, though the market may not have fully priced in the development.

Bitcoin Faces Double-Top Warning Amid Short-Term Rally Prospects

Bitcoin's recent stagnation NEAR the $123,000 mark belies brewing volatility. The MVRV 365-Day Moving Average signals a potential double-top formation—a pattern last seen before the 2021 bear market. Analysts project a second peak around September 10th, which could precipitate a cascading decline.

CryptoQuant's Yonsei Dent notes the timing coincides with macro catalysts like anticipated Fed rate cuts. 'The lagging MVRV 365DMA suggests late August may seed the downtrend,' he warns. Despite these headwinds, on-chain data shows steady accumulation—a testament to enduring institutional interest.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market developments, BTCC's Emma provides these projections:

| Year | Price Target (USDT) | Key Drivers |

|---|---|---|

| 2025 | 90,000-130,000 | ETF flows, halving aftermath, macro conditions |

| 2030 | 250,000-400,000 | Institutional adoption, scarcity premium, regulatory clarity |

| 2035 | 600,000-1,000,000 | Network effects, store-of-value status, fiat alternatives |

| 2040 | 1,500,000+ | Global reserve asset status, full monetization |

Note: Predictions assume continued adoption without black swan events. Volatility remains inherent to crypto markets.